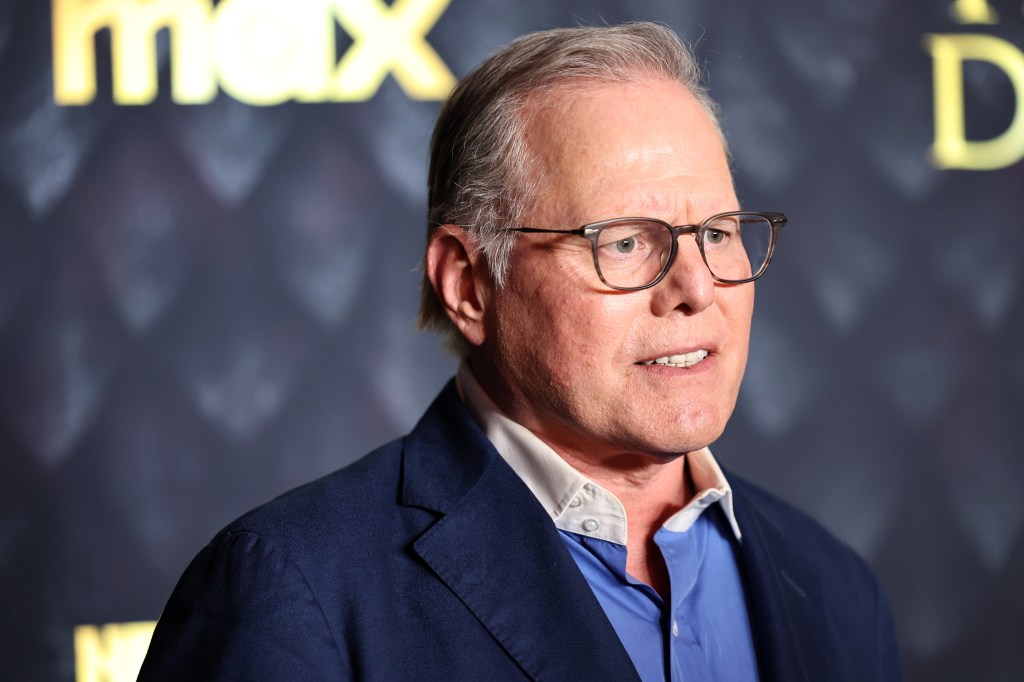

Warner Bros. Discovery and its beleaguered CEO David Zaslav finally have reason to celebrate in 2024.

The company, formed from the 2022 merger of WarnerMedia and Discovery, has seen its share price plummet 70% since the deal closed, with a series of abuses culminating in the loss of NBA rights – pending a legal complaint – starting with the 2025-26 season. .

In August, S&P lowered its outlook for WBD from “stable” to “negative,” citing declines in the media company’s cable TV business that could be worsened by the potential loss of NBA rights.

However, that streak was dramatically reversed on Thursday when the company announced an early renewal of its offer at Charter Communications, the largest pay-TV operator in the US. Max is integrated into most of Charter’s Spectrum cable and broadband systems. Unlike a similar deal between Charter and Disney a year ago, no WBD networks were left without transportation.

The stock rose 10% on Thursday’s news – the best performer in the S&P 500, and is up another 10% on Friday on the deal, which provides debt-laden Warner with a steady stream of much-needed cash and a foundation for other stock markets. distributor agreements as they arise.

“Warner Bros. Discovery has been under pressure over the past year for a number of reasons, but one of the bigger issues is what will happen during the next round of upcoming renewals,” MoffettNathanson’s Robert Fishman said in a note. “Deals are often called win-win. They rarely are. This one could be it.”

Few details emerged about the terms of the deal, but Zaslav said at a media conference Thursday that affiliate fees for flagship TNT remained stable despite uncertainty about the NBA’s future on the network. The combined payout for all channels rose from the current deal, he said. “We kept the price on TNT and in total we got more money for our cable business for our 30 channels,” he said. “And all our channels are broadcast. No channels have been removed.”

Charter and Spectrum have 13.3 million pay TV subscribers and 30.4 million broadband subscriptions.

Seaport Global’s David Joyce called the extension “surprising” and the stock revived “as affiliate fees remain in place, especially for TNT, which continues to carry the NBA games for another season, reflecting the distributor’s confidence in the value proposition that he expects to offer. maintained in the future. The importance of this early Charter renewal is to demonstrate that WBD will at least maintain price, although subscriber cuts may remain under pressure.”

Darius Morris of the Los Angeles Lakers blocks shot by Monta Ellis of Milwaukee Bucks in the 2024 NBA game

Harry Hoe/Getty Images

As WBD’s fortunes slumped in recent months, as the home of Warner Bros., HBO and CNN saw its market value fall to nearly $16 billion (a tenth of Disney’s), some on Wall Street implored the company to break up or to sell themselves. . The NBA’s loss led in part to a massive $9 billion writedown on linear television assets. There was speculation that an activist investor, a la Nelson Peltz, would strike. And where on earth, Wall Streeters wondered, was scheming billionaire John Malone, Zaslav’s longtime mentor and protector on the board, as his personal stake in the company dwindled in value?

Well, “Malone is on both sides of the equation here,” noted Rich Greenfield of Lightshed Partners. The cable pioneer is a major investor, both Charter and WBD.

Zaslav’s compensation packages, occasional tone-deafness and tendency to abandon creative projects have not endeared him to Hollywood’s rank and file. A photo of the CEO wearing a backwards baseball cap, sitting with Elon Musk at the US Open, recently drew ridicule when it circulated on X. “That’s all you need to know,” sighed a powerful friend of Zaslav’s recently in a chat with Deadline. “I tried to tell him.”

The Pols also did their best. “The merger of Warner Bros. and Discovery has, I think, overshadowed the idea of mergers in the entertainment sector for years to come,” representative Joaquin Castro told Deadline. In April, the Texas Democrat, along with Sen. Elizabeth Warren (D-CA), Rep. David Cicilline (D-RI), and Rep. Pramila Jayapal (D-WA), sent a letter asking AG Merrick Garland and DOJ antitrust chief Jonathan Kanter to to investigate merger because of “potentially anticompetitive practices that limit consumer choice and harm workers in affected labor markets.” It appears that no action has been taken on this.

“Most financial indicators coming out of Warner Bros. Discovery are negative,” Castro tells Deadline. “The stock price… they laid off thousands of employees. They dumped content for tax purposes. They have closed several platforms. … The only thing that is flourishing is the CEO’s compensation.”

RELATED: Warner Bros. Discovery Shareholders Slam CEO David Zaslav’s Compensation in Say-On-Pay Vote

Zaslav’s 2023 package was valued at $49.7 million, up 26% from 2022. In 2021 it was worth $247 million, swollen by stock options. Every year, part of his pay is tied up in stock options granted at different exercise prices, many of which remain underwater. The company recently changed its formula to tie more of its pay to cash flow, given the urgent need to pay down debt.

Investors can tolerate the pay better than, for example, the unions, and have known Zaslav since his early days at Discovery, through the merger with Scripps and the ambitious takeover of Warner Media, a smaller company that buys a larger company and piles up debt in the process. Other major media companies have been laying off staff and writing down content, they note, and in the current climate, Discovery and Warner Media are stronger together than individually. The conglom has reduced its debt, expanded Max internationally and redecorated its studio with bright spots such as Beetlejuice Beetlejuice and upcoming Joker: Folie à Deux And The penguin series on HBO.

Michael Keaton in ‘Beetlejuice Beetlejuice’ (Warner Bros./Everett Collection

Yeah, Wall Street hasn’t really been excited about Zaslav and WBD lately. But after the latest soft quarterly earnings, many said the most important thing is the next round of pay-TV innovations, which will determine whether Turner can still thrive without the NBA. Would affiliate rates drop dramatically at TNT and Turner more broadly? Could there even be a loss of transportation?

So far so good.

It was a big surprise that Zaslav got the Charter deal done, “especially one that had less than a full year to run,” said one Wall Streeter.

RELATED: Fubo tells judge in antitrust case that it will reveal long-secret details of carriage negotiations by Disney, Fox and Warner Bros. Discovery

Turner/TNT has had the rights to broadcast NBA games since 1989 and started streaming them on Max last year. But as the final extension approached, WBD allowed an exclusive negotiating window to expire without a deal and the NBA subsequently awarded a trio of packages to incumbents Disney/ESPN, NBCUniversal and Amazon Prime Video.

Warners was contractually entitled to matching rights and made an offer that it said matched Amazon’s package, the least expensive of the three at about $1.8 billion per year. The NBA under commissioner Adam Silver rejected it, saying this was not the case. He said Amazon is escrowing billions of dollars for payments versus WBD’s offer for a line of credit from banks — “not even close to the same,” the league said in a counter.

Warner has sued the NBA. No one really sees a victory. Zaslav said today that WBD still hopes to have the NBA “for the next eleven years…depending on how that works out.”

In another “when it rains” development, WBD is a partner with Disney and Fox in the joint streaming venture Venu Sports, whose launch was blocked by a federal judge last month after $74 million in startup costs.

Charter, led by CEO Chris Winfrey, has put together a streaming package for subscribers as it renews carriage deals (adding Disney+, Paramount+ and, most recently, AMC+). WBD contributes Max with advertising, and Discovery+ expands the Max footprint.

The length of the contract was not disclosed, but as the industry changed, these agreements tended to shrink from a five-year standard to two or three years. Here, only the first one is guaranteed the NBA.

The Charter Agreement takes this uncertainty into account. It also sets the stage for a series of other renewals, starting with Comcast at the end of this year and more in 2025.

“The terms were better than investors expected,” Greenfield said.

Another question lingering after Thursday’s extension is whether it provided a template for the WBD’s upcoming negotiations. Wall Street thinks so. But according to the current battle between DirecTV and Disneynothing is certain. “These deals are never easy,” WBD chief financial officer Gunnar Wiedenfels noted at a media conference last week. “They have never been easy because there is no such thing as a market price, and the stakes are high.”

Anthony D’Alessandro contributed to this report.