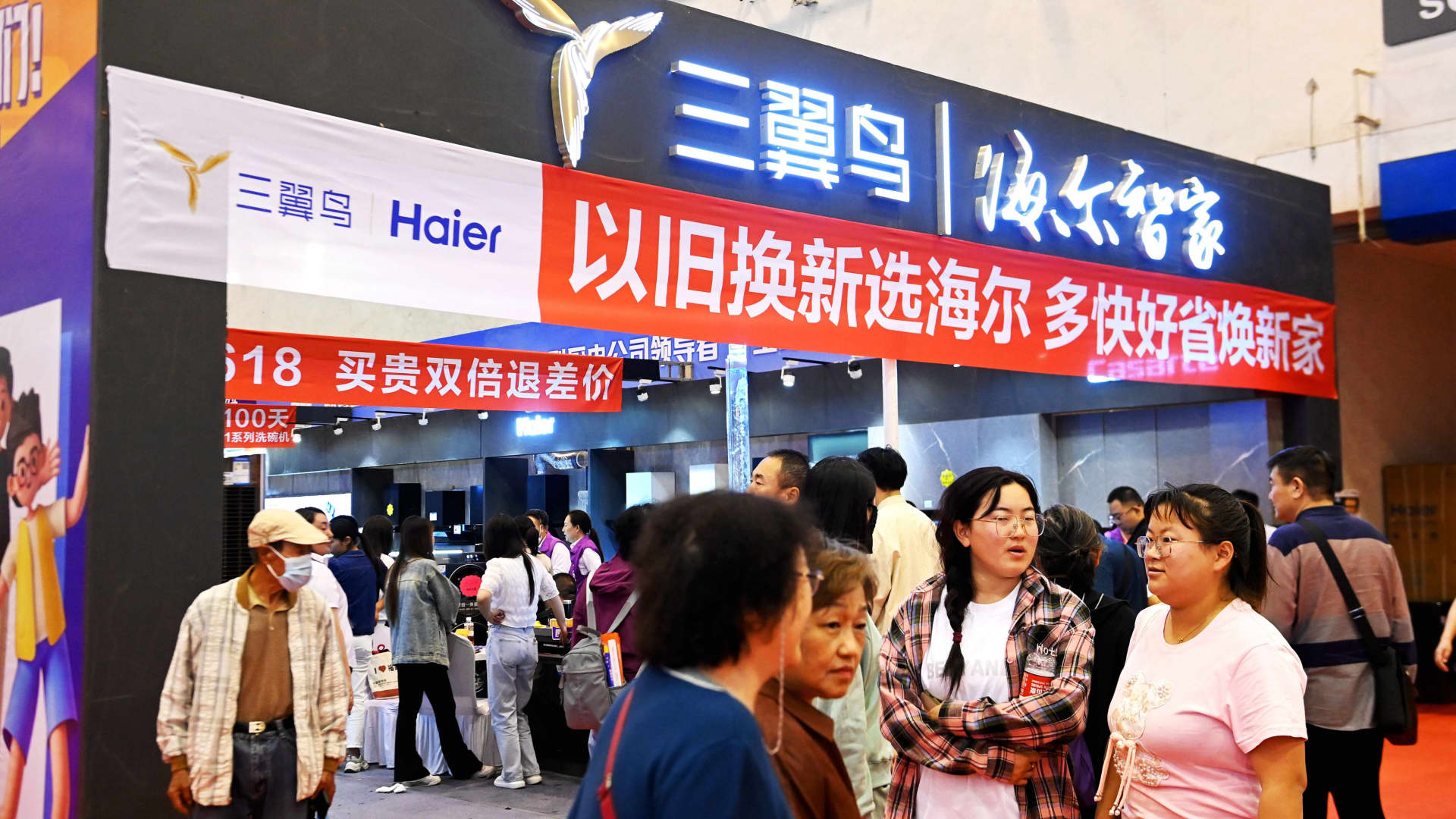

A banner highlights China’s trade-in policy at a household goods fair in Qingdao, Shandong province, China, on June 1, 2024.

Nurfoto | Nurfoto | Getty Images

BEIJING – China’s plan to boost consumption by encouraging trade-ins has yet to yield significant results, several companies told CNBC.

China announced in July the allocation of 300 billion yuan ($41.5 billion) in ultra-long special government bonds to expand its existing equipment trade-in and upgrade policy, in a bid to boost consumption.

Half of that amount is intended to subsidize the trade-in of cars, home appliances and other higher-priced consumer goods, while the rest is intended to support upgrades to major equipment such as elevators. Local governments can use the ultra-long government bonds to subsidize certain purchases by consumers and businesses.

While the targeted move to boost consumption surprised analysts, the measures still require prudent Chinese consumers to spend some money upfront and have a used product to trade in.

“We are not aware of any companies that have seen this translated into concrete incentives on the ground in China since the measures were announced,” Jens Eskelund, president of the EU Chamber of Commerce in China, told reporters earlier this week.

“Our encouragement would be that we now focus on execution [for] visible, measurable results,” he said.

The chamber’s analysis found that the total budgeted amount of the central government’s policies is about 210 yuan ($29.50) per capita. Considering that “only part of [it] reaches households, this plan alone is unlikely to significantly increase domestic consumption,” the organization said in a report published on Wednesday.

Analysts are not overly optimistic about the extent to which the trade-in program could support retail sales.

Tao Wang, chief economist at UBS Investment Bank, said in July that the new trade-in program could support the equivalent of about 0.3% of retail sales in 2023.

Chinese retail sales for August are expected Saturday morning. Retail sales rose 2% in June, the slowest since the Covid-19 pandemic, while sales growth improved modestly in July at 2.7%.

However, sales of new energy vehicles rose nearly 37% in July, despite a decline in overall passenger car sales, according to industry data.

The trade-in policy more than existing subsidies doubledFor the purchase of new energy and traditional fuel vehicles, the price is 20,000 yuan and 15,000 yuan per car, respectively.

Waiting for elevator modernization

In March and April, China had already started rolling out policies to support equipment upgrades and trade-ins of consumer products. Around the measures announced in late July, officials noted that 800,000 elevators in China had been in use for more than 15 years, and 170,000 of them had been in use for more than 20 years.

Two major foreign elevator companies told CNBC in August that they had not yet received any specific new orders under the new equipment upgrade program.

“We’re still in the very early stages of this whole program right now,” said Sally Loh, president of China Operations for U.S. elevator company Otis. Companies are aware of the total amount of money, she said, but “in terms of the amount allocated for elevators, it hasn’t really been clarified.”

“We see that there is certainly a lot of interest from local government to ensure that this type of central government funding is effectively deployed to the residential buildings that most need this replacement,” she said, pointing to the announced funding. really helps solve some of the financing issues that we saw as a major concern for our customers.”

Otis sales of new equipment in China fell by double digits during the second quarter, according to figures from An release of income. No income is broken down by region.

Finnish elevator Kone said its sales from Greater China dropped by more than 15% in the first six months from 2024 year on year to 1.28 billion euros ($1.41 billion), dragged down by the real estate crisis. That was still more than 20% of Kone’s total turnover in the first half of the year.

“We’re certainly excited about this opportunity. We’ve been excited about it for a long time,” said Kone CFO Ilkka Hara. “This is more of a catalyst that will allow many to make a choice.”

“I definitely see opportunities in the future,” he said. “How quickly it will become a reality is difficult to say.”

Hara pointed out that new elevators can save more energy compared to older models, and said Kone plans to grow its elevator service business in addition to unit sales.

Outlook on the second-hand market

It may take some time for central government policies to be implemented locally. Several major cities and provinces only have this details announced in recent weeks on how the trade-in program would work for residents.

For ATRefreshwhich operates stores for processing second-hand goods, the ultra-long government bond program to support trade-ins will have no short-term impact, said Rex Chen, the company’s CFO.

But he told CNBC that the policy supports the longer-term development of the second-hand goods market, and he hopes there will be more government support for building trade-in kiosks in neighborhood communities.

ATRenew focuses on the pricing and resale of selected second-hand products. The company claims it became Apple’s trade-in partner in mainland China last year.

In specific categories and regions – such as mobile phones and laptops in parts of Guangdong province – trade-in volumes did increase this summer, Chen said.

According to ATRenew, trade-in orders coming from e-commerce platform JD.com have increased more than 50% year over year since the new policy was released. The time frame was not specified.

– CNBCs Sonja Heng contributed to this report.

Correction: This story has been updated to reflect that ATRenew is Apple’s trade-in partner in mainland China.