By Nora Buli and Forrest Crellin

OSLO/PARIS (Reuters) – Europe has clocked a record number of hours of negative energy prices this year due to a mismatch between supply and demand as solar power generation soars, potentially helping shift investment to much-needed storage solutions.

Wholesale energy markets in most of Europe’s major economies showed zero or negative prices for a record number of hours in the first five months of this year, during times of low demand. This means that producers have to pay more often to turn off power or shut down their power stations.

“You could certainly say that success is currently consuming its own offspring,” Markus Hagel, an energy policy expert at German utility Trianel, told Reuters.

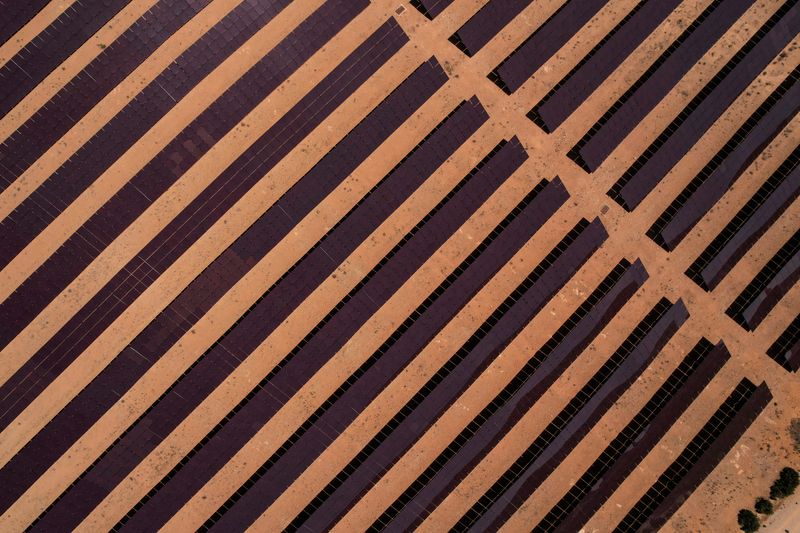

Strong hydro and nuclear power generation have played a role in the oversupply, but Europe has also seen a huge expansion of solar energy.

According to data from SolarPower Europe, installed solar capacity in the European Union has more than doubled to 263 GW between 2019 and 2023. In 2023 alone, that equates to 306,000 additional solar panels being installed every day, the group said.

In the day-ahead market, this has led to more European markets experiencing price drops at the lowest demand point in the middle of the day.

Trianel told Reuters the company has invested in 800 megawatts (MW) of photovoltaic capacity and has a project pipeline of 2,000 MW, but lower prices are forcing the company to reconsider how it sells the power.

Solar energy has boomed in part because subsidies were no longer needed as developers agreed power purchase agreements (PPAs) with buyers on fixed terms linked to wholesale energy market prices.

This allowed for a faster and larger buildout than previous limited volume auctions for government-backed payments.

But as prices drop, developers are increasingly turning to subsidy schemes, Hagel said.

Negative prices are nothing new for Germany, which hosts Europe’s largest solar and wind power generation capacity, but 2024 is the first year Spain will see them, after several years of strong solar growth.

“It is not something that worries us at the moment. What does worry us is that it will repeat itself or could be repeated over time,” said José María González Moya, director general of the Sustainable Lobby APPA Renovables, adding that new contracts for PPAs are already declining.

“And yes, in a sense, investments are slowing down. Don’t stop, slow down,” Moya said.

Germany and Spain are still leading the PPA market, says Jens Hollstein, head of advice at PPA pricing platform Pexapark. However, solar power producers were forced to sell their power to 24-hour generators at increasingly large discounts.

“The margin is getting thinner,” Hollstein said.

He expected a slowdown in investments as development continued.

On the other hand, the energy market is now seeing a wider gap between low and high hours, increasing the incentive to invest in storage, he added.

INCREASING BATTERY STORAGE IS ESSENTIAL

The International Energy Agency (IEA) highlighted the urgent need for energy storage in an annual report.

“Developers who choose not to co-locate their wind and solar farms with battery storage or other sources of flexibility could see a drop in potential revenue during peak generation – hampering profits and discouraging investment,” the IEA wrote.

The EU estimates that energy storage in the bloc will need to more than triple between 2022 and 2030 to match forecasts of a 69% share of renewable energy in the electricity system by then.

Norwegian renewable energy producer Statkraft, which operates across Europe, has said it could divest some wind and solar projects but would likely keep its battery assets.

“For batteries, it will be positive if there is greater volatility and also negative prices,” said CEO Birgitte Ringstad Vartdal, because batteries can be charged when prices are low, while production can be sold when prices are high .

“That is one of the reasons why flexible projects will be attractive,” says Ringstad Vartdal.

In addition to storing energy in batteries to deal with periods of oversupply, other options such as AI-powered smart grids and meters can also help consumers optimize their electricity use.

Domestic end-users, plagued by the rise in energy costs in the wake of the war in Ukraine, have yet to enjoy lower bills as they are often locked into long-term contracts.

Only consumers who have invested in a heat pump, a charger for their electric car or a storage system can benefit from negative prices, according to a spokesperson for the German association of local utilities VKU.

Those with fixed-price contracts will only feel a positive impact from negative energy prices once they have driven down average market prices over the long term.